Yes, I Said It, The Apple Card is WHACK!

Yes, you just heard me call the Apple Credit Card, in my opinion, it’s whack, and especially if you know about credit cards within the game. You’ll realize this is a very mid-range, mediocre card, and Apple, once again, is using the Apple distortion field to make something look way better than it actually really is, which is a mediocre, middle of the range sort of starter card, and you could be doing a lot better with other cards out there.

Apple has sort of taken advantage of what I feel a lot of people out there has, lack of credit card knowledge, to be able to promote this to being, once again, better than what it is. Let’s start by talking about the card itself.

What is The Apple Card?

The Apple card is titanium, which is cool, but to be honest with you, the novelty of that wears off fast. I have two metal cards that are like that, and it was pretty cool for the first couple of times I played around with it, but after a while, the novelty, as I said, wears off. You end up paying online a majority of the time, or you end up using tap to pay, and that’s what I particularly do with Samsung Pay.

It’s a clean design, just a magnetic strip and your name on it, and the built-in chip in there with it, and that’s all you get. There is no credit card number or anything on it. You have to get that information from your iPhone, which it’s directly connected to, and use the security built into the iPhone and your face ID to be able to get the numbers and the CVV PIN and things like that when you want to make purchases with the card.

It’s good that they have the security built-in there with that, nice that they protect that. A lot of digital wallets use virtual numbers anyway, so even if you have your card in there, it usually gives another card out when you use it for tap to purchase with it anyways, and you have another number and CCV code that you give them to protect it, so the store doesn’t directly have your card. They have another card with it. It’s cool that they’ve done that feature, but it’s not something that’s, I would say, totally revolutionary with that. Now, that’s pretty much the card itself.

While Apple Isn’t A Bank, It wants you to Think It Is

Goldman Sachs is the bank issuer behind the Apple Card. Apple is taking more of a front face to this, so it’s not just a branded card. It’s kind of Apple saying, “Hey, “this is the credit card that we’re offering to you.” But since they’re not an official bank, they have enough money to be one, but since they’re not an official bank itself, they have to use an issuer, and Goldman Sachs is essentially the issuer for it.

It is also a MasterCard, which is okay. MasterCard cards tend to be in the mid-range, starter-type cards, versus Visa, which tend to have more higher-tier, premium credit cards. MasterCard does have World Elite, so they have a few of them out there that are called MasterCard World Elite cards. You see that on there, you do get some premium features with that, but they tend to be in the middle of the road. If the card is a Visa and has Visa Signature and Visa Infinity logo you do give you some pretty cool benefits, which we’ll talk about a little bit later.

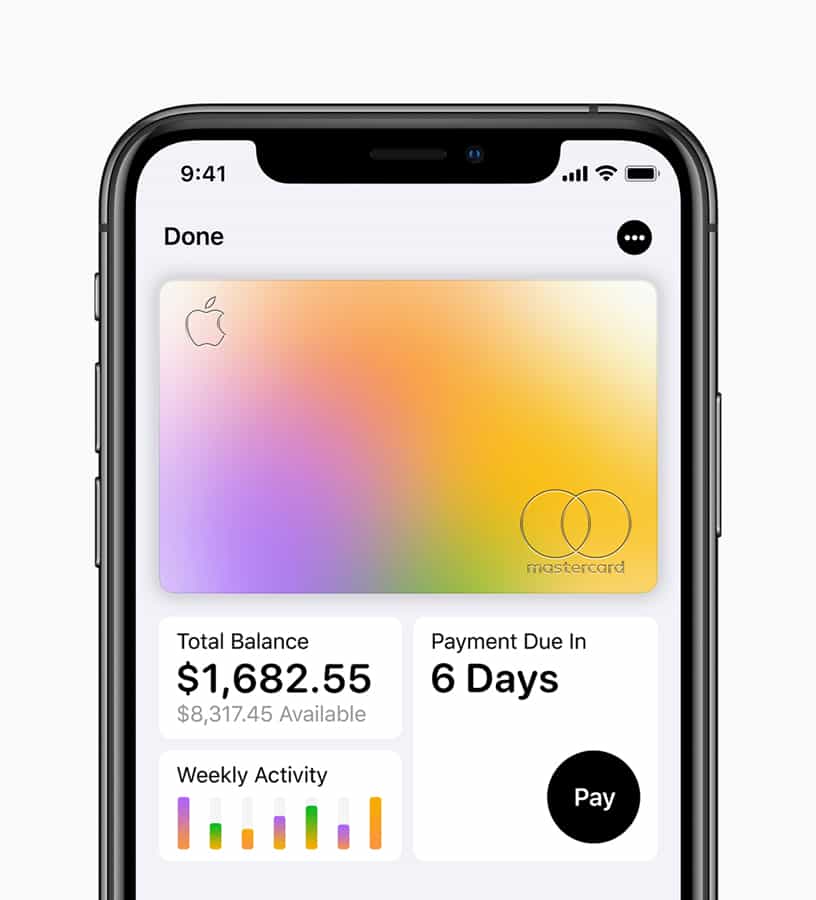

Apple Card Tight Wallet Integration Is Solid But Lacking

Apple, of course, has its Apple Credit card tightly integrated into with the Wallet app, and it gives you sort of this nice tracking feature. You can see all your history and your payments. You get some graphs and things like that about how you’re spending and what you’re spending on your card, payment reminders, and interest rate estimates and things like that. Pretty cool to have built into an app, but there are so many other apps out there that do this a lot better and give you a total financial picture, not just about one card.

You’ll also want to know about your checking account, banking account, your 401Ks, your loans, you know, the wholistic credit card view. You were looking for trackers that sort of give you that information out there. If you’re tight on privacy, yes, they have some tight privacy controls over your data purchases within the Apple Card, so that might be something important to you, and you might want to go with that in particular. But if you want to have your full personal financial picture, you want something like Personal Capital or Mint, the former which I use myself. There are some other ones out there to get more of a holistic picture over your financial situation, which is going to help you make better purchasing decisions overall when you have that.

No Fees For The Apple Card

Apple also boasts about having no fees on this card, no late fees, no foreign transaction fees, and things like that. Pretty cool for a card at this tier to not have any foreign transaction fees. It’s pretty good to have, because you usually have to get that with higher-tier travel cards, so you don’t have to pay that percentage.

No late fees, which are nice to have, but you also should have your card set, any credit card that you have. You should have it set to at least paying the minimum base payment automatically, and then paying it off in full to avoid interest, or pay it as close as you can to pay as little interest as possible because life changes and things can change like that.

But you want to make sure at least the minimum payment is guaranteed to be paid off to avoid any late fees, because if you do get late, even if Apple isn’t charging you, they might report that to your credit bureau. Having a late fee on your credit report or late payment on your credit report marked is pretty significant, and will pull your credit down dramatically, and those stay on there for seven years. The impact weakens over time, but within the first two years, it could really affect any other cards or any other types of credit that you might want to get, so make sure you have auto-pay turned on for at least the minimum payment to avoid any missed payment.

Apple Card’s Cash Back Reward System

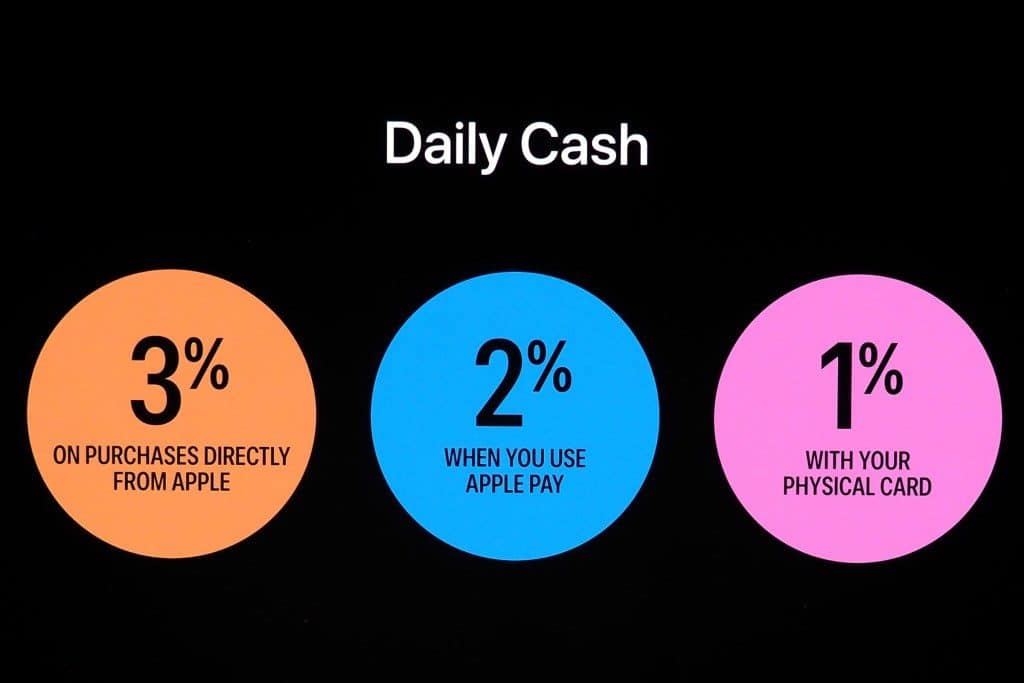

Now, let’s talk about the rewards system that you have here with the Apple Card. It’s a 3-2-1 cashback card, basically, so it’s 3% back on all purchases from Apple, Apple.com, I’m assuming iTunes as well, too. That’s nice if you have a lot of spend at Apple, within the Apple Store, within the iTunes store. You get 3% back on that. That’s the highest percentage cash back you could earn within the card. Eh, not the best, but it’s there for that reason, obviously, because it’s Apple.

Now, it has 2% back here at any time you use Apple Pay, so you need to make the website, app or physical store support Apple Pay or you will only get 1% back which is the where everything else you chare falls if it doesn’t fit the criteria of the other two percentages.

The rewards system is very meh compared to the other ones out there, and yes, they do give you cashback within 24 hours. Nice that it has that. It’s kind of them rebranding sort of the purchase eraser sort of thing that happened with a lot of other cards. Capital One has that, so does Bank of America, and a few other cards as well, too.

A Better Way to Earn More Cash Back

You can use your cashback instead of taking it back as cash, which you can do with the Apple Card here and deposit it into your bank account. They say, “Well, you can use it right away.” That’s nice, but truthfully speaking, with rewards, you want to build those rewards up to get something later down the line. You don’t want to be instantly using it right away. That’s, again, another sort of, they’re trying to say something is a benefit, but it isn’t how you should be using your rewards. That’s what I want to talk a little bit more about here, is how, when you’re dealing with credit card rewards, you want to the best reward system for the type of spending, and the type of rewards that you want have with it.

Two biggest ones out there are Chase Ultimate Rewards and Amex Membership Rewards. Those are the two big ones everybody uses. Everybody has a system, but those two tend to have the best bang for your buck and the best value possible, and I’m going to explain to you here how you can get better value through another card if you’re going to make an Apple purchase than you would go with the Apple card.

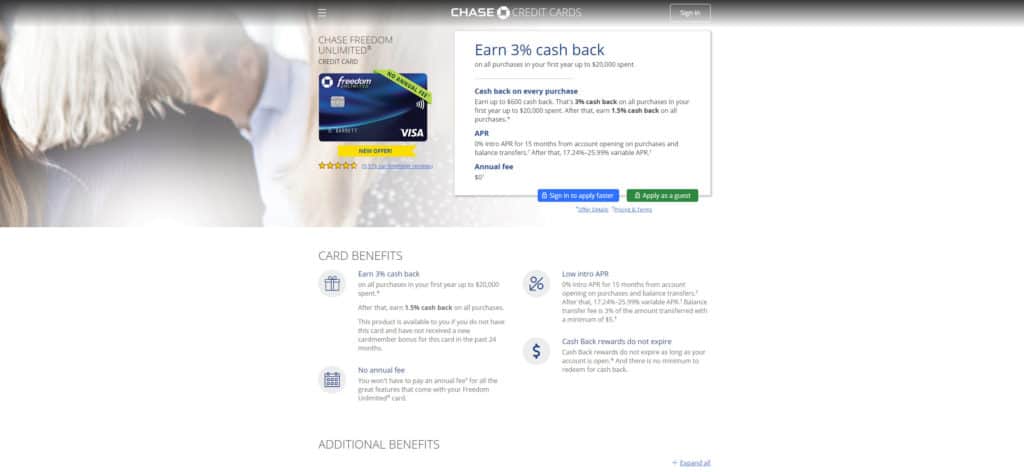

So, the card I’m going to talk about right now is the Chase Freedom Unlimited card. I typically stay in the Chase Ultimate Rewards program. It has some nice benefits and features, and it’s really easy to get everything together and get the best bang for your buck when it comes to the point. So, the Freedom Unlimited is the card I’m going to use in comparison to the Apple Card here, and they’re kind of in the same tier. Right now, Chase Freedom has a deal. For the first year, you earn 3% back on anything you swipe on the card, up to $20,000 within the first year, so that’s already a big feature to have.

It also has 15 months zero interest, so if you need to pay for a big purchase, which a lot of Apple products are big purchases. Let’s say you’re going to college or something like that, and you need something for school, you need to get a laptop or something, you can pay that off over time with no interest that you have to pay on it.

Apple, from what I see, they don’t have zero-interest or interest-free period from what I’ve seen within the fine print or any other purchase. They could run some special in the store. Who knows, that could kind of give you that, but as I can see right now, it doesn’t seem like they have that, but let’s go back into comparing it to the Chase Freedom.

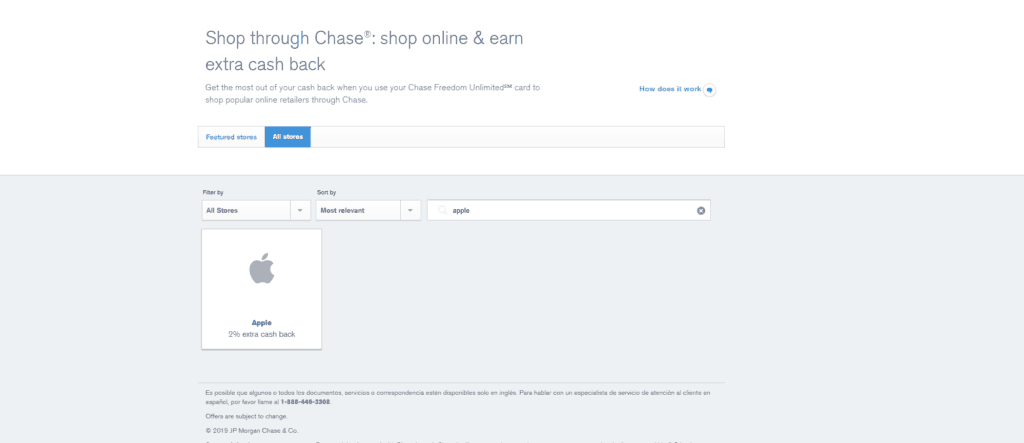

How To Get 5% Cash Back On Apple Using Chase

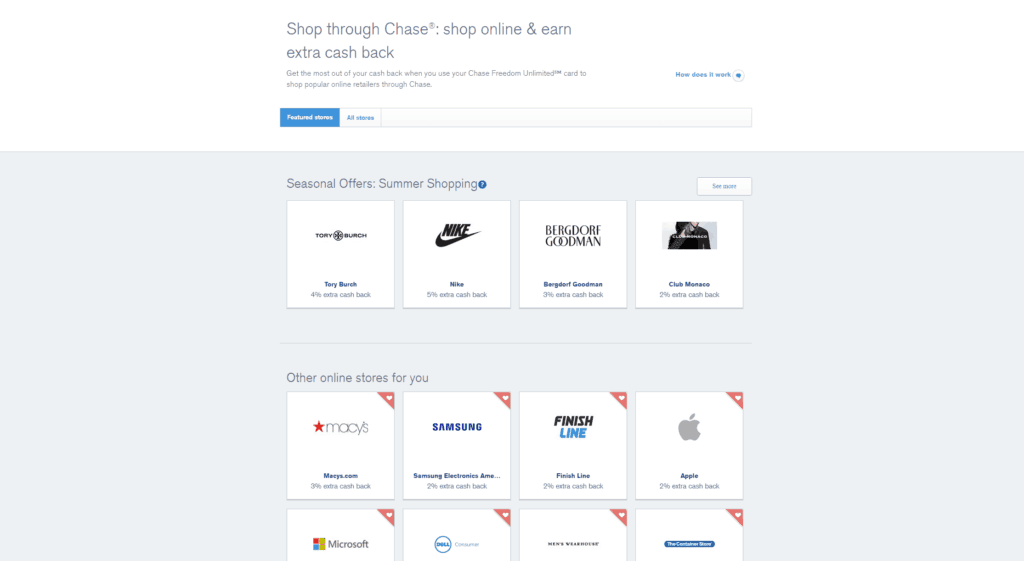

Now, you get the 3% back with that. You also get the 15 months zero percent APR on that as well, too. The APRs will roughly be about the same after the promotional period ends, but Chase has something called Shop through Chase. You go through Shop through Chase; Apple is on there. You get 2% back, actually, if you go through Shop through Chase, click on it, it basically puts a cookie within your browser, opens up to the Apple website, and if you make a purchase all the way through there, which you should do, even if you want do in-store pickup, you’ll be able to earn an extra 2% back.

So you get 3% on the basic, or 3x on just the purchase alone, then, because you went through Shop through Chase, you get an extra 2% on top of that as well, too, or 2x. I know I’m using it interchangeably, but you get my point here. So, you can earn 5% back, versus the 3% back that you earn from Apple.

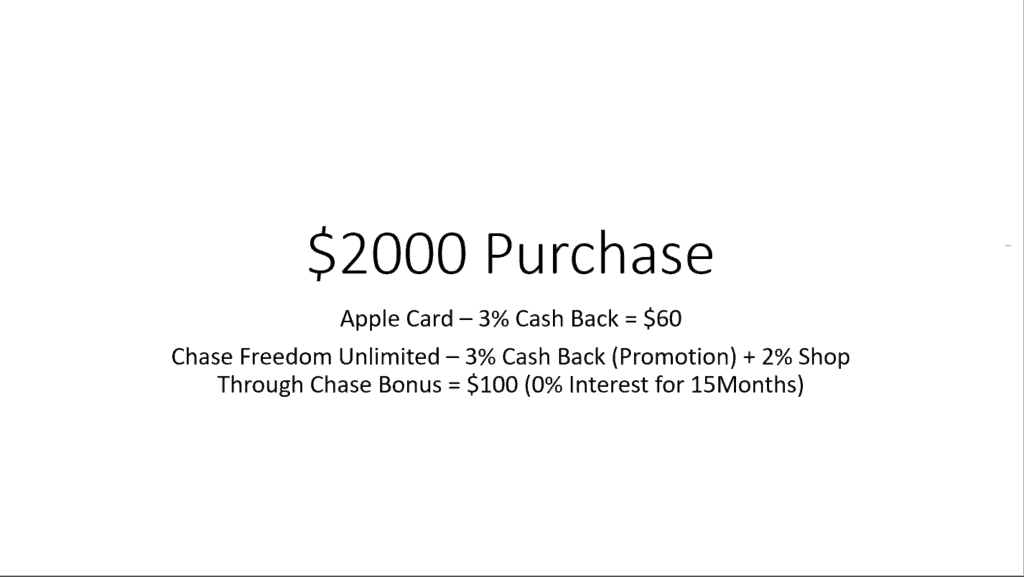

Comparing that out here, let’s say you make a $2,000 purchase. If you do it through the Apple Card, you’re only going to get about 3% of that back. You’re going to have to pay interest, probably, over time, and you’re probably looking at something about a little above $60 or so back in terms of cashback there with it if I’m doing the math right off the top of my head. That’s nice, but the interest is going to eat up the cashback that you’re getting anyway, so you’re not benefiting from that.

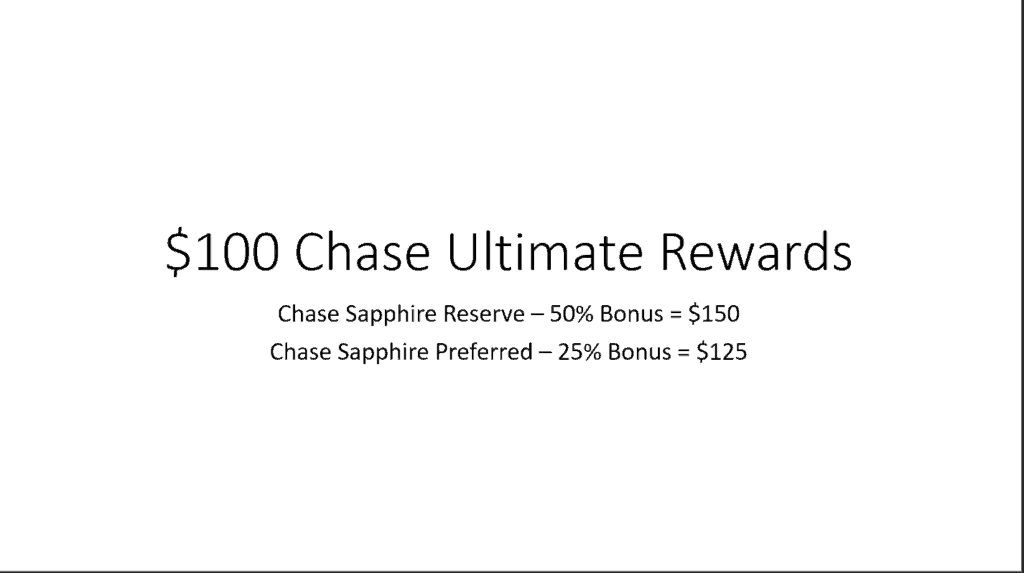

If you do what I said to do and go through Shop through Chase, you’re going to earn 5% right now on that, which is going to give you $100 back. You’re going to have zero interest on that for the next 15 months, and that $100 is in your pocket. That’s cashback that you can take and throw it into the bank if you want to, or you can use it to erase some purchases, whichever you choose to do, make a statement credit, whatever, but the whole idea with Chase Ultimate Rewards is truthfully to build up those reward points over time. You eventually will want to get a travel card to earn more value on these points when you transfer them. to a Chase Sapphire Preferred Or Reserve travel credit card

With Ultimate Rewards, you can transfer points between the cards, so you can take that $100 that you got from your Apple purchase, push that down to your Chase Sapphire Reserve Card. If you buy travel through the Ultimate Rewards portal you’ll gain 50% more on your points So that $100 will be $150 in travel rewards or $125 if redeeming through a Sapphire Preferred card instead.

If you don’t want to do that, you still get the cashback as you normally would, and you’re still getting more cash through Chase’s system than you are going to get through Apple’s system. And the nice thing about Chase’s system is, well, I just mentioned there that going through Shop through Chase, and the Apple site’s on there, there are tons of sites on there that are available to earn more bonus cashback on, including with the basic cashback number that you get with the Unlimited Card there.

Apple Card Is Whack And You Can Do Better

As you can see that you earn a whole lot more doing it in this direction than you would do it with anything else, and quite frankly, that’s where I see the flaws in the Apple Card, why I call it to whack, and why I think you with getting other cards. The “Flex of the decade” for just the status is not what you want to look for when you’re talking about credit and your financials. You want to get the best bang for your buck. You want to get the best cashback you can get for them, and you need to be as responsible as you possibly can be, and you also want to get the best travel benefits that you want to as well, too. All three of those should matter to you when you’re thinking about the credit cards that you’re getting.

I can recommend three resources that you can go to if you want to learn more about credit cards. I’ve listed the sites below. I know this isn’t quite tech-related, but I wanted to get this information out there, just because I wanted to make sure you guys got the proper information and get the best bang for your buck, get the best value, to be honest with you. Questions, comments, concerns, please post them below. Let me know what you guys think here.

Credit Card Education Recommend Resources

The Credit Shifu (YouTube) (Website)

Comments